The latest round of U.S. tariffs is reverberating across the real estate and construction sectors—and for investors, the message is clear: rising construction costs.

Underwriting assumptions need to evolve.

Over the past few months, the relentless inflation of material costs has been chipping away at margins and disrupting timelines across almost all asset classes. Whether you’re supporting residential communities, build-to-rent portfolios, or mixed-use developments, the impact is starkly evident in the financials.

What’s Changing?

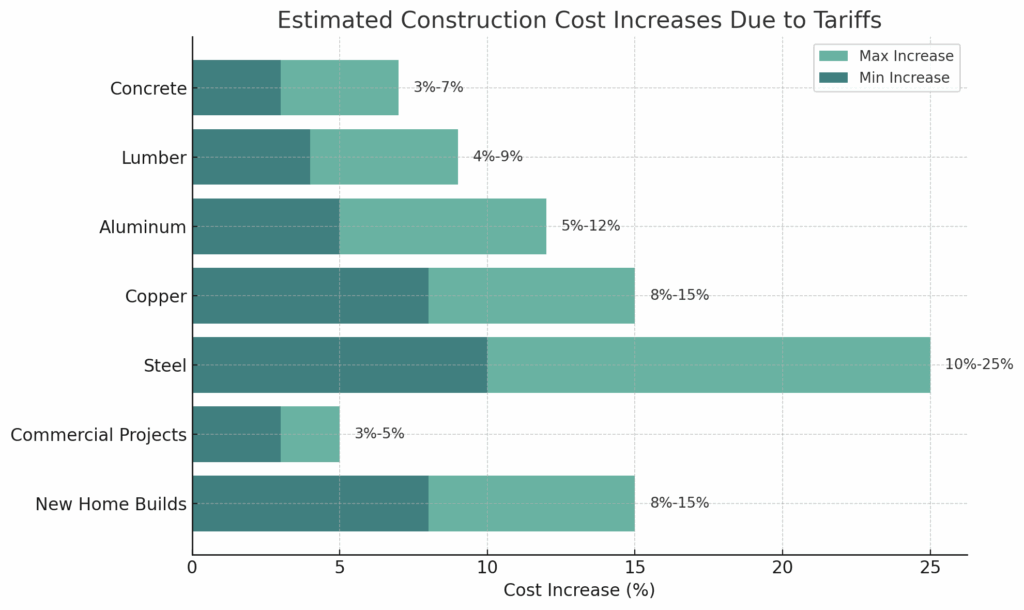

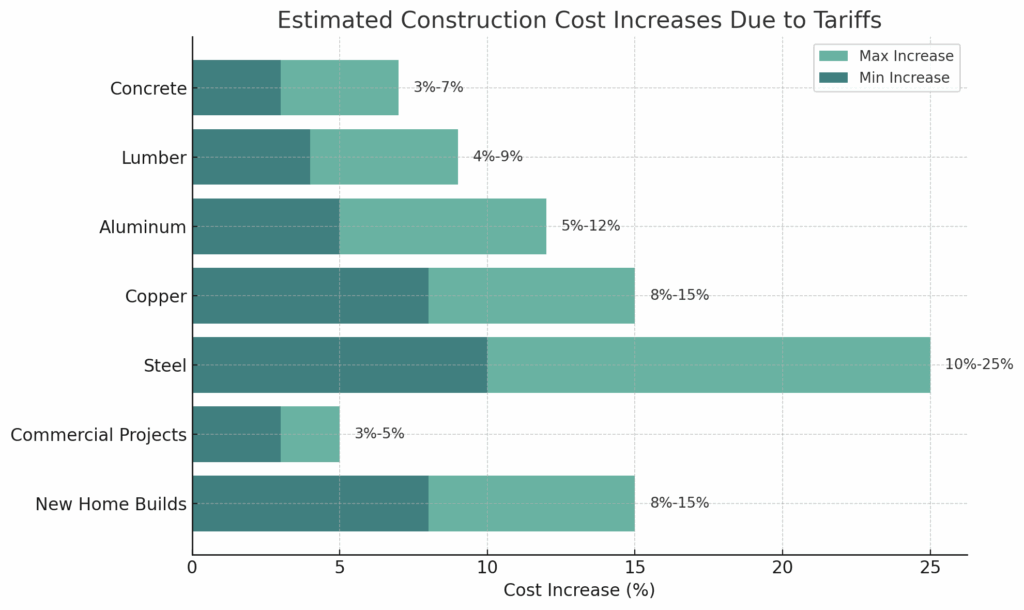

Construction inputs are rising fast, often faster than end prices can keep pace:

Early Signs of Market Impact

• Housing starts are down 14.2% as of March—the lowest in eight months

• Consumer behavior is shifting: 30% of Americans are postponing major purchases, and 25% are canceling them entirely

• Developers are pausing deals or revising models mid-cycle

Implications for Investors

If you’re capitalizing on projects in this environment, here are the key considerations:

1. Re-underwrite Immediately

Hard costs have shifted significantly. Sponsors who haven’t updated budgets since Q4 2024 are likely underestimating exposure.

2. Focus on Developer Agility

Partners with boots-on-the-ground capabilities and control over construction (GC or affiliated build teams) are better positioned to manage volatility.

3. Mitigate Execution Risk

Ask about procurement timelines, supplier diversification, and contingency strategies. The cheapest deal may not be the most resilient.

4. Prioritize Location and Product Resilience

Markets like Florida, mainly coastal or high-demand pockets, can better absorb pricing shifts due to persistent demand. Product types with service-based revenue or long-term hold strategies may also fare better.

5. Monitor Policy Movements

Trade policy is highly political. A change in administration or global relations could reverse or deepen the current impact—stay informed.

Our View

At Lana Development, we’re adapting quickly, revisiting budgets, accelerating procurement, and doubling down on local supplier networks. Projects with the proper fundamentals and flexibility still present attractive returns. But in this environment, investor discipline is everything.

I’d be happy to connect if you’re evaluating real estate allocations or need support with stress-

testing construction-heavy investments.

Sources:

#RealEstateInvesting #ConstructionCosts #Tariffs #CRE #DevelopmentStrategy #InvestorInsights #RiskManagement #newdevelopment #realestateinvestor